What would be the effects of a major loss of business travel?

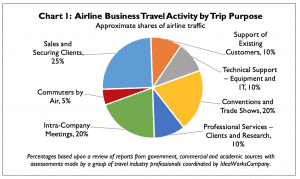

Corporate travel is made of many types. Here are the seven sectors that this expert team established.

- Sales and securing clients

- Support of existing customers

- Technical support

- Conventions and trade shows

- Professional services — Clients and research

- Intra-company meetings

- Air commuters

These categories were then broken into whether the travel was for customer support and acquisition or internal operations. Finally, we looked at each sector. After about a month of study, we made our educated guesses about what travel would be lost because of technology and what business operations could not be replaced.

The airline experts came from executives, journalists, analysts, and advocates

The group of experts included an airline executive, Ben Baldanza, once the CEO of Spirit Airlines and currently serves on the board of directors of JetBlue. Scott McCartney, the Middle Seat creator for the Wall Street Journal, was our journalist. Jay Sorensen represented airline analysts. And I was the passenger-advocate. The four of us worked together on creating the report over about three-to-four months or so.

We began a weekly meeting at the start of the pandemic as an opportunity to examine the aviation industry as it all but shut down. Airline executives and journalists struggled with defining this travel. We all knew of the importance of corporate travel to the industry. Our working group decided that we could add to the aviation knowledge by trying to define just what is business travel.

Next, we took a deep dive into each category of travel to see how they would be affected by changes in technology. Past experience showed that technological changes such as fax machines, computers, cell phones, and so on, did not dilute the need for business travel. But, today’s changes seemed different. Not only was technology improving, but work changes were getting established, and habits were changing.

All sectors of travel did not suffer uniformly

Conventions and trade shows would return. The interactions with clients and the ability to see new changes in competing products could not be replaced by technology.

Intra-company meetings was another large group to consider. This section was most in danger of losing to technology such as Microsoft Teams, WebEx, Zoom, and others. Our discussions noted that future meetings might have only one or two members of a 10-20-person sales team traveling, with the remainder joining by video conference. We estimate that as much as 60 percent of this travel could be lost forever.

Both air commuters and client services may lose between 50 and 60 percent of their portion of business travel. And existing company support and technical/IT support would face fewer travel losses.

Our analysis of business travel broken into categories seemed to limit the impact of COVID-19

Our analysis of business travel broken into categories seemed to limit the impact of COVID-19

If we had only considered professional services, technical support, intra-company meetings, and commuters, a prediction of about 50 percent loss of business travel would have been a close approximation. However, when the entire breadth of such travel was included, our conclusions ranged from a permanent loss of 19 to 36 percent.

READ ALSO

DOT releases a deceptive definition — is it unfair?

Are airline disinfectants safe for humans?

How does losing business travel affect leisure travelers?

Let me count the ways.

- Business travelers provide international airlines such as American, Delta, and United with about 50 percent of their revenues.

- One might say that corporate travel subsidizes leisure travel. This business managed travel certainly affects route frequency.

- Leisure travelers will find their airfares increasing when business travel drops.

- International airlines depend on upscale travel like Lufthansa, Singapore, Emirates, and British Airways.

- Domestic airlines such as Southwest, Spirit, Alaska, and Allegiant carry very few businessmen compared to the Big Three. Their aviation economics will be much more stable than those of network carriers.

- And the travel economic effects beat goes on.

A significant drop in corporate managed travel will change the airline industry. This study may help airlines learn how to cope with an uncertain future.

The 14-page report includes a 6-point checklist advising airlines how to transform their companies to meet the challenge. The full report is available to view at: ideaworkscompany.

Charlie Leocha is the President of Travelers United. He has been working in Washington, DC, for the past 14 years with Congress, the Department of Transportation, and industry stakeholders on travel issues. He was the first consumer representative to the Advisory Committee for Aviation Consumer Protections appointed by the Secretary of Transportation from 2012 through 2018.