What appear to be a-la-carte service costs are really resort fees in disguise

Swim with us for only $50/day.

This hotel, as the article points out, charges guests to access the hotel pool. What the article does not point out is that the pool fee is a whopping $50 per person (plus tax). For two adults, that is an additional $200 (plus tax) to stay at the hotel pool over the weekend.

The pool may be expensive, but the hotel also charges a hefty illegal hotel resort fee.

It is illegal to charge taxes on Internet services.

The most appealing amenity provided by the facility fee, the hotel alleges, is the “fastest Wi-Fi in New York.” However, it’s obvious that this hotel is lying because not only are they not providing the fastest internet in New York (Google in Manhattan probably has faster internet), but it is illegal for the hotel to even claim this fee pays for Internet services. Why? Internet service cannot be taxed due to the Internet Tax Freedom Act.

Is the TWA Hotel cheating on hotel taxes?

This brings us to the taxing issue of resort fee taxes. Many hotels, like the TWA Hotel, have used illegal hotel resort fees to cheat on New York City hotel taxes. When the TWA Hotel opened, they charged New York City 8.875 percent sales tax on their resort fee. This sales tax should apply to services.

The hotel’s facility fee, however, provides no actual services. It is simply a way for the hotel to lie about the advertised price of the room. The fee, since it is part of the mandatory nightly room rate, should actually be taxed at 14.75 percent, which is New York City’s daily hotel tax.

NYC loses every time anyone stays at the TWA Hotel.

Many hotels in New York City are taxing resort fees (facility fees) at the lower sales tax rate instead of at the rate designated for hotel room rates. That’s cheating 5.875 percent tax per room, per night, in a city with well over 100,000 hotel rooms. This equates to tens of millions of dollars of loss to New York City annually.

Today the TWA Hotel is charging the 14.75 percent hotel tax on their illegal facility fee. Though that’s certainly an improvement from when they opened, incorrectly charging only 8.875 percent tax, the fee should not exist at all. In the time the hotel charged the incorrect amount of taxes on one of their two nightly room rates (one advertised, one hidden as a facility fee), New York City was losing 5.875 percent per room per night, which is hundreds of thousands of dollars that the TWA Hotel cheated from New York City taxes that certainly could have helped in the pandemic.

Welcome to false hotel advertising 101!

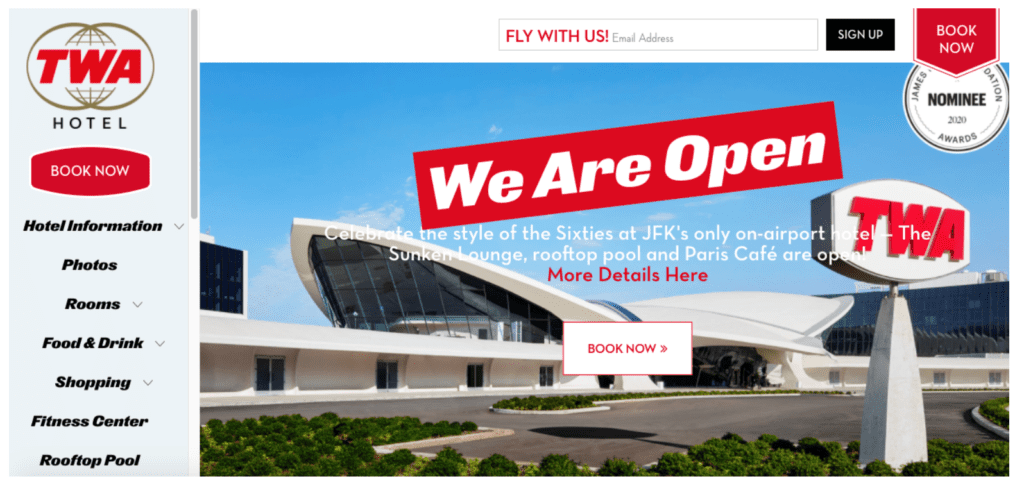

The TWA Hotel is one of the most deceptively advertised hotels in the United States. They charge a deceptive, illegal facility fee that they did not even tax properly when they opened. They also advertise amenities that are not included in the stay. On the TWA Hotel’s website (twahotel.com) it says “Celebrate the style of the Sixties at JFK’s only on-airport hotel – The Sunken Lounge, rooftop pool and Paris Café are open! More Details Here. Book Now.”

When a customer clicks on “More Details Here” they are brought to a page with details about the Rooftop Pool. Nowhere does it say that the pool costs $50 per adult and $20 per child to enter. It is advertised as if it is an included amenity of the hotel.

The TWA Hotel website makes no mention of the $140 extra swimming pool charge for a family of four.

Back to the main TWA Hotel website (twahotel.com), the first thing advertised after “Book Now” is “Make a Splash at the Pool-cuzzi. Our rooftop pool-cuzzi with runway views is heated up to 95 degrees daily for registered hotel guests. Reservations are required.” Again, no mention that this pool could cost a family of four $140 to visit on a Saturday.

If the family wanted to visit the pool two different days during their stay, that’s an extra $280 dollars that they likely thought was included in the room rate. And that’s on top of the daily illegal $15.63 facility fee. If a family of four wanted to come to this hotel for the weekend to enjoy the prominently advertised pool, they may book under “Book Now” on the website and never know that to actually visit the pool and get the key to their room, the hotel will actually say they have to pay an unadvertised amount of $311.26. That is an incredible amount of money to be surprised with when they check into the hotel.

You can fight the additional charges of $311.26 in pool and facility fees. Complain to the NY Attorney General.

Luckily, there is a way to fight these deceptive hotel fees. If you stay at the TWA Hotel and are charged an illegal facility fee or/and you believe you were subject to deceptive hotel advertising, file a consumer complaint with the New York Attorney General. The New York Attorney General is in charge of enforcing the laws of the State of New York. The TWA Hotel’s use of a facility fee in hiding their true room rate is illegal. New York has a law (New York General Business Law § 349) that prohibits the use of a hidden fee for any purchases in the state.

File a Consumer Complaint with the New York Attorney General Here

READ ALSO:

A dozen RV mistakes to avoid to happily travel on the road

In a Kindle age, six reasons I take paperback books on vacation

Lauren joined Travelers United in 2015. Founded Kill Resort Fees, the only site devoted to ending hidden hotel resort fees. Armed with an arsenal of frequent flyer miles and some extreme budgeting skills, Lauren traveled around the world through 37 countries. Accomplishments include eating at the world’s largest restaurant in Syria, bungee jumping off the Victoria Falls Bridge on the Zambia/Zimbabwe border, running into Anthony Bourdain at a Mexican restaurant in Cambodia and cage diving with Great White Sharks in South Africa.